Hi I’m Brandon Schwab from Chicagoland NW Suburbs. I’m 41 years old and I’ve been investing in real estate full time since 2010.

I now run a real estate debt fund specializing in the senior living sector.

Over the last 13+ years investing I’ve learned A LOT- both from my wins and much more from failures.

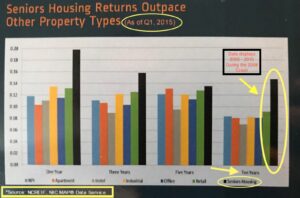

1. Success leaves clues if you PAY attention. Study assets past performance during last recession and learn from what happened. Study the 10 year graph of this NIC Map. I learned that real estate is always a great place to be and apparently senior housing is the #1 performing asset class during last 2008 crash. Success leaves clues, pick them up.

2. You WIN or You LEARN— You will Learn More from your mistakes/failures than your wins! You must fail faster and get through it ASAP. Great example is Baseball, it’s a game of failure that professional players get paid millions to hit 3 out of 10. Michael Jordan failed many times and because of that is why he became a success. I started coaching my son’s travel baseball team and saw first hand the lessons learned from failures stunk much more at first but impact was greater.

3. Just Do It— Nike Slogan “Just Do It” is critical during a recessionary environment as many are scared and afraid to take action. My favorite quote in life is by Wayne Gretzky “you’ll miss 100% of the shots you never take”. Stop over analyzing deals to death. Find a space you love or have a passion for and jump as Nike says “JUST DO IT”. At the end of your life, you’ll never regret having taking action that provided more quality time with your family.

4. Life is Short, Be Present with Your Family— You never know what will happen tomorrow, enjoy today and be PRESENT with your family. Read the book Lifeonaire by Steve Cook. I’d rather be full of life than a Millionaire if forced to pick one or the other. Put the phones away (especially in front of your kids) and be truly present

5. Be Like A Farmer— Buy (or invest) in real estate and wait. Albert Einstein stated that “Compound Interest is the 8th Wonder of the World”. Learn ways to use compound interest and invest passively… like a farmer. Imagine if a farmer planted their seeds and 2 weeks later expected to go harvest their crop? It doesn’t happen that quickly… buy (or invest in) real estate and wait.

BONUS #6 Find a Mentor- If you think the cost of education is expensive, try ignorance. Ignorance can be 10X more costly than education. Find a mentor that has accomplished what you want to and find ways to add value. Work for free, help however needed, add value to get experience.

QUESTION:

Which one of the above is your favorite?

Do you have another valuable lesson to share from last 2008 Crash to help others?

Those are all great and baseball is a great metaphor for life.

Agreed 100%! You can learn a lot from the game of baseball that directly apply to life. Did you ever play or what was your favorite sport?

Yes, played Baseball growing up. Football was my favorite. I’ve been watching my son play baseball over the last 12 years and have watched all the great lessons he’s learned preparing him for life.

Hard to pick a favorite from the above they’re all so great but probably #3 and #4

Happy to have you in the club

Thank you! Technology today is a blessing and a curse at the same time depending how we use it or be controlled by it. What is your passion @Shawna?

I’m currently really active towards expanding myself in all areas of life – of course via financial growth which is why I’m here, but honestly a heavy load of spiritual, mental and emotional wellbeing too right now.

And as a mother (I guess also as a “daughter, sister, aunt, niece” too) I’m really interested in being a pivotal plot twist on the familial spectrum. Or at least thats what I’m telling myself, not sure how or in which ways just yet, but strongly believe it’ll be true..

Definitely coupled with creating and acknowledging [COLLECTIVE] action, community involvement, being of service etc. Why I really enjoy the people in this community (and Money School Community too)

I guess that boils down to being passionate about “NAVIGATION, and CONFIDENCE” perhaps! GOOD QUESTION I don’t ponder or answer enough~!